The CCC Group has developed a distinctive, globally unique business model built on an omnichannel platform that integrates both full-price and off-price channels. The model relies on the seamless interplay of online and offline sales, enabling customers to migrate effortlessly between the two.

CCC Group business model

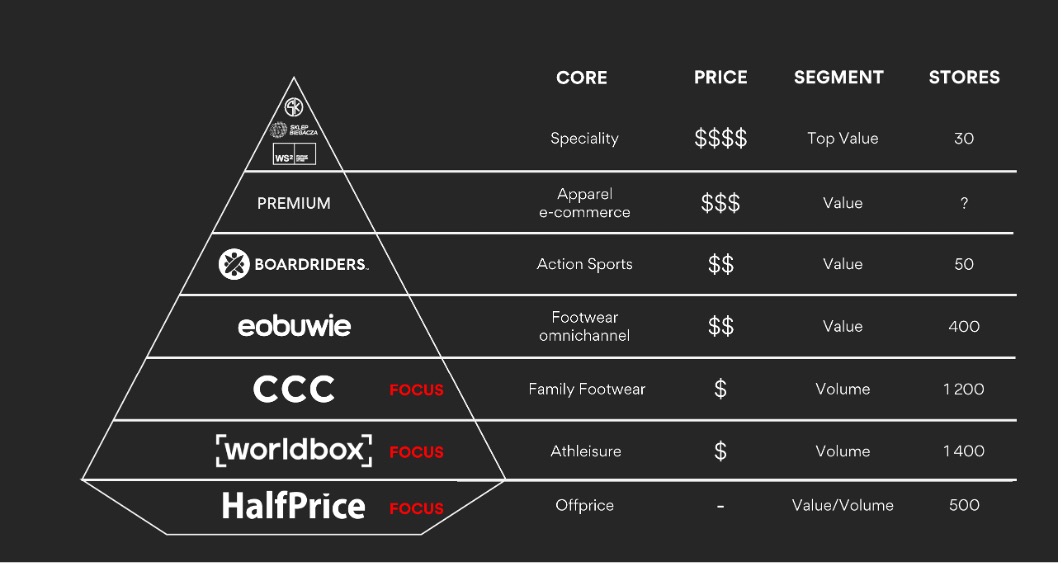

The Group distinguishes a set of strong, complementary sales formats: Full-price channel – the CCC and eobuwie business lines, the franchise-operated Worldbox, and specialist stores Warsaw Sneaker Store, Sklep Biegacza and Sklep Koszykarza. Online sales – to be consolidated, in the longer term, under MODIVO.COM S.A. Off-price channel – the HalfPrice business line. A detailed description of each sales format and the associated product portfolio is provided in the section ‘CCC Group portfolio’.

CCC Group segmentation pyramid

The CCC Group’s business model is structured around product and customer segmentation: each sales format complements the others in terms of product offer, sales channel, price tier and target customer segment. This architecture enables the Group to meet the needs of every customer cohort and to manage brand positioning consistently across all channels and price points. It also provides a scalable platform for launching new sales formats and for fully leveraging the Group’s licensing model. The development priorities for 2025–2030 have been built on this segmentation framework.

DEVELOPMENT PILLARS 2025–2030

The Group’s growth strategy rests on three pillars: licensed brands, expansion of retail floor space, and a strong e-commerce business.

1.Licensed brands

Since 2023 – when the first licensing agreements were signed with the owner of Reebok – the Group has been steadily adding new brands under the licensed-brand model. A detailed list of licensed brands offered by the Group is provided in the section ‘CCC Group portfolio’. A higher share of licensed brands in the sales mix supports gross-margin expansion by eliminating a range of costs, including intermediary charges. Margins on licensed products are broadly in line with those on own-brand merchandise, but – on comparable items – licensed products command higher average selling prices. Because licensed brands enjoy far wider recognition than the Group’s proprietary brands, their presence increases customer interest in the Group’s offer, particularly in international markets, lifting store traffic, conversion rates and, ultimately, like-for-like sales.

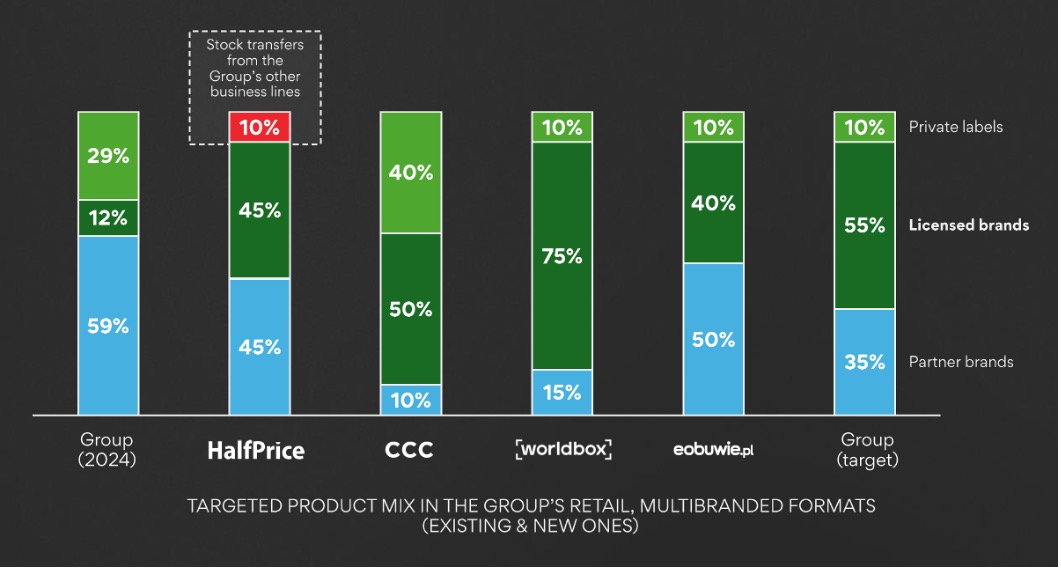

At present, licensed brands are offered mainly through the CCC business line, but the Management Board intends to roll them out across all of the Group’s sales formats. The long-term target is for licensed brands to account for up to 55% of Group sales.

Target share of licensed products in CCC Group sales

Beyond increasing the proportion of licensed brands in its sales mix, the Group intends to keep expanding the number of those brands. Each addition is preceded by rigorous analysis to ensure the new brand meets customer needs and complements the existing portfolio. Licensed brands will be introduced selectively across the Group’s sales formats: some will be available exclusively in a single format, while others will appear in several – or all – formats. Even where a brand spans multiple formats, strict segmentation principles will apply: the products will differ in features such as build quality and materials, reflecting the price tier and target customer of each format.

The Group also plans to leverage its access to licensed brands – and the relationships it has built with licensors – to build market share in new product categories, with apparel as the primary focus. To this end a new Worldbox sales format has been launched, offering mainly licensed-brand apparel.

Given the high consumer recognition of licensed brands – which improves the scalability of the business – and the additional control over brand messaging provided by segmentation, expanding the licensed-product range is a natural path for further growth and is expected to make a significant contribution to the Group’s profitability.

2. Expansion of retail floor space

The growing share of high-margin licensed products, combined with the resulting scalability of the business and the opportunity to launch new sales formats, underpins the Group’s decision to accelerate the expansion of its retail footprint. This decision is further supported by the Group’s strong negotiating position on lease terms – securing prime locations in shopping centres and retail parks, with a high proportion of turnover-based rents – and by the attractive profitability generated in the offline channel. The Group sees potential to almost triple its retail floor space by 2030, from approximately 850 thousand square metres in 2024 to about 2,350 thousand square metres.

Potential for expansion of CCC Group retail floor space

The main contributor to floor-space growth will be the HalfPrice business line. The Group plans to open around 350 HalfPrice stores, adding about 800 thousand square metres of selling area by 2030. These targets relate to expansion in Central and Eastern Europe. The Group also views Southern Europe – initially Spain and Italy, and subsequently Portugal and Greece – as attractive growth markets. At present, HalfPrice stores are operating in Spain and Italy.

The enhanced appeal of CCC’s range – thanks to the partial replacement of own-brand lines with widely recognised licensed brands – justifies further expansion of the store chain. Additionally, the growing number of newly opened retail parks in Poland and across the CEE region allows the Group to increase its presence in smaller towns. Overall, the Group plans to open around 400 new CCC stores by the end of 2030.

Eobuwie offline stores have adopted a new format from 2025 that features physical product displays. The curated offer in these new stores will focus on the best-selling, most popular and highest-margin, fast-turn brands. The Group plans to open around 350 stores in this format by 2030, and the existing eobuwie chain will be remodelled and adjusted to the same concept. This initiative is one of the pillars of the Modivo Group’s profitability recovery plan.

In 2024, the CCC Group acquired a 10% interest in MKRI Sp. z o.o., operator of the Kaes chain, which has almost 150 outlets across Poland, mainly in smaller towns. Kaes stores sell apparel from well-known global brands. Leveraging the CCC Group’s access to licensed apparel and Kaes’ retail know-how, the Group has decided to launch a new sales format – Worldbox – which will stock primarily licensed-brand apparel. Operations in Poland will be run under a franchise model, with MKRI acting as franchisee and managing the stores. The outlets currently trading under the Kaes business line will be converted progressively to Worldbox stores. Locations outside Poland will be operated directly by the CCC Group. The aim is to expand the Worldbox chain to nearly 1,400 stores in Poland and the CEE region by the end of 2030. The chain will benefit from intra-group synergies such as joint purchasing of collections and collective negotiation of store leases.

3. Strong e-commerce business

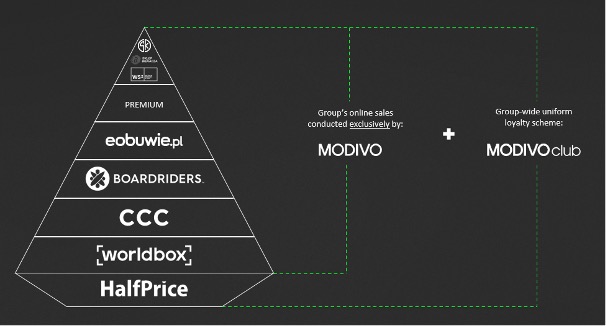

The Group is pursuing a series of initiatives to restore the profitability of its e-commerce operations. The revised approach calls for full consolidation of online activity under the Modivo business line – all of the Group’s online sales will be channelled through Modivo. Modivo will deliver logistics, photography and check-out services for the Group’s entire e-commerce operation, becoming the profit centre for the online business.

New operating model for Modivo

At the centre of the new approach is Modivo Club, a unified loyalty programme spanning all of the Group’s sales formats. Although the Group counts nearly 21 million customers, they are currently distributed across individual business lines. Unifying the customer base will facilitate cross-selling between formats, increase share of wallet and lift annual margin per customer, while reducing paid-traffic costs.

The product portfolio is being continuously optimised: unprofitable brands have been delisted and terms with other suppliers renegotiated. Following a review of Modivo’s operations, the Group implemented a number of cost-saving measures: it discontinued certain customer-facing services (such as Reserve & Collect), closed the distribution centre in Romania and streamlined logistics processes.

Management believes that these initiatives – reinforced by a higher share of licensed products in the Modivo Group range and the expansion of the eobuwie offline store chain – will position Modivo to become the most profitable e-commerce business globally.